The Concept of Using Property as Collateral

Using property as collateral involves offering a tangible asset to secure a loan. This practice can help borrowers access larger amounts of credit at potentially lower interest rates, as the risk to lenders is reduced. Collateral often includes real estate or other valuable assets, providing a safety net for lenders in case of default.

Benefits of Secured Borrowing

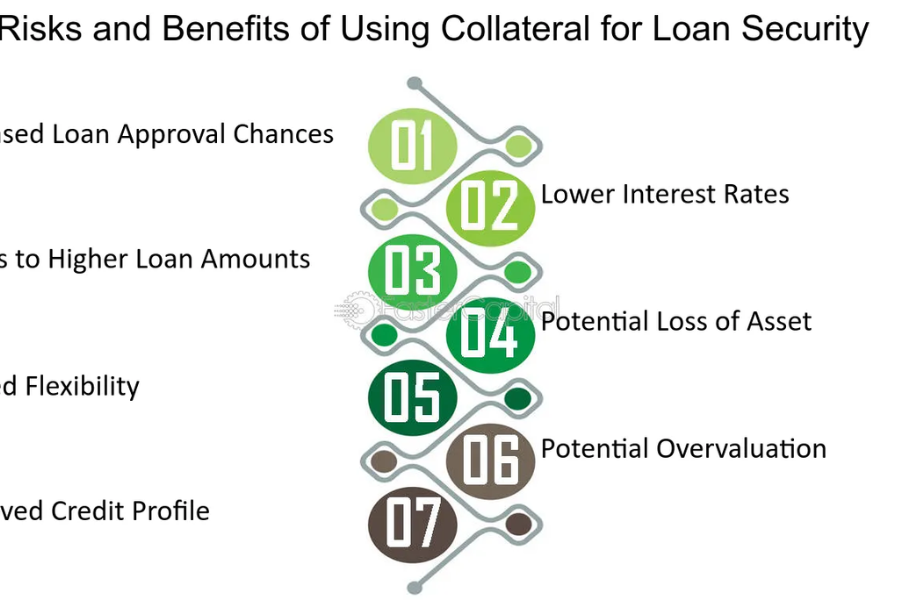

Secured borrowing, where property is used as collateral, can offer several advantages. Typically, it comes with lower interest rates compared to unsecured loans, as the lender has a tangible asset to claim if the borrower defaults. Additionally, having collateral can make it easier to secure larger loan amounts and favorable terms. Secured loans are particularly useful for individuals looking to finance significant expenditures or consolidate existing debts.

Risks Involved with Using Property as Collateral

While using property as collateral can be beneficial, it also involves risks. If the borrower fails to repay the loan, the lender has the right to seize the collateral, which could result in losing the property. This risk makes it essential for borrowers to carefully evaluate their ability to meet loan repayments before agreeing to use property as security.

Impact on Creditworthiness

Offering property as collateral can impact one’s creditworthiness. While it can improve access to credit, failure to meet repayment obligations can damage credit scores and affect future borrowing opportunities. It is important to maintain a good repayment record to avoid negative repercussions on one’s credit profile.

Alternatives to Using Property as Collateral

For those who prefer not to use property as collateral, several alternatives are available. Unsecured loans, personal loans, and lines of credit are options that do not require collateral but may come with higher interest rates or stricter qualification criteria. Understanding these alternatives can help borrowers make informed decisions about their borrowing needs.

Legal and Financial Considerations

When using property as collateral, it’s crucial to understand the legal and financial implications. Contracts should be reviewed carefully, and the terms of the loan should be clearly understood. Consulting with financial advisors or legal professionals can provide valuable insights and ensure that the terms are fair and manageable.

Long-Term Financial Planning

Incorporating property into financial borrowing strategies requires long-term planning. It’s important to assess how the loan will fit into overall financial goals and to plan for future repayment. Effective financial management ensures that the use of collateral does not lead to undue financial strain.

Conclusion

Using property as collateral for financial borrowing can offer significant benefits but also involves considerable risks. By understanding both the advantages and potential downsides, borrowers can make informed decisions that align with their financial goals and ensure that they manage the associated risks effectively.

Keep an eye for more news & updates on DiscoverTribune!